Investing basics

As a member of a Retirement Savings Plan, you're an investor. This is because when you join the plan, your contributions are automatically invested for you in the plan's default option. This is a good option if you prefer to let experts make the investment decisions for you. However, you can choose to select your own investment funds from the range your plan offers.

What is an investment fund?

A fund pools money from lots of investors. The fund manager then spreads that money across a variety of investments.

You can choose from a range of funds managed by Fidelity and other leading fund managers. These focus on different sectors, regions and types of investment. Whatever funds you choose, you benefit from the investment expertise and management of a professional fund management team.

Learn about investing

Types of investment

The different types of investments are often referred to as ‘asset classes’ – some common examples include company shares (or ‘equities’), bonds, property and cash.

The performance of different asset classes will naturally vary over time. As they all have their own unique characteristics, wider market conditions and world events will affect them differently. That’s why it’s important to spread your money over a range of investments – it enables you to manage the risk of your retirement savings falling in value if one asset class is out of favour. Investors usually call this strategy ‘diversification’. Diversification aims to manage the investment risk. It cannot eliminate it.

Diversification is essentially the principle of ‘not putting all your eggs in one basket’.

If you spread out or ‘diversify’ your savings across several different type of investments, in line with your retirement goals and risk tolerance, you’ll be in a better position to withstand any potential losses from a single asset class.

Watch the video to learn how diversification can help in times of market volatility.

Watch time: 1 min 30 seconds

More about the main asset classes

Most of us are familiar with cash. We know it in its physical form and keep it in our bank accounts. But what does it mean when your savings are investing in cash and money market instruments? Cash and money market instruments are lower risk investments aimed at investment returns similar to bank/building society interest rates. Although these are the least risky of the asset types, cash can still fall in value over the long term due to the effects of inflation and charges/fees if exposure is obtained through funds or other products. If this happens, it might look like the amount in your account is rising in value but what you can actually buy with it will be less (this is known as the value falling in ‘real terms’). Cash funds also have fees that may reduce the level of interest you receive.

A bond is a loan to a company or government, and it pays a fixed rate of interest. The value fluctuates in line with the market and how likely it is the loan will be repaid. Bond funds normally sit somewhere between cash and equity funds, as they offer the potential for more growth than cash with more risk – and less growth than equities with less risk. However, this does not mean they have no risk. The level of this risk can be higher in volatile markets, during periods of unpredictable and sometimes sharp price and interest rate movements, which means that the value of your investments can fall in value dramatically during those periods.

An equity (also known as a company share) represents part-ownership of a company. While you cannot invest directly in shares in your plan, you can put money in funds that hold the shares of many different companies. The investment return of an equity fund depends on the performance of the companies it has invested in and how keen investors are to buy these shares. Some companies may also pay out part of their profits in the form of dividends. Equity funds tend to offer more growth potential over the long term than many other asset classes, particularly bonds and cash. However, they also tend to involve more risk and their value can go down as well as up, particularly in the short term.

In investment terms, property tends to mean commercial buildings, such as offices, factories, warehouses and retail spaces. Property funds benefit when prices rise (though it’s important to remember properties can fall in value as well) and the funds should receive rent from their tenants. Their biggest drawback is that properties can be much harder to buy and sell than most other types of investments (to use the technical term, they are ‘illiquid’). This can create challenges if you need to take your money out of a property fund when the market is going through a difficult period.

Risk and return

The relationship between risk and return is one of the most important aspects of investment. For you as an investor, risk relates to the possibility that you may not achieve your financial goals or that you get back less than you invest.

Generally speaking, the greater the risk you are prepared to tolerate, the more potential there is for your investments to grow but also a greater chance of loss. Conversely, lower-risk investments tend to offer more stable returns but less opportunity for significant growth. As in all investments, the value of your investments can go down as well as up, so you may get back less than you invest.

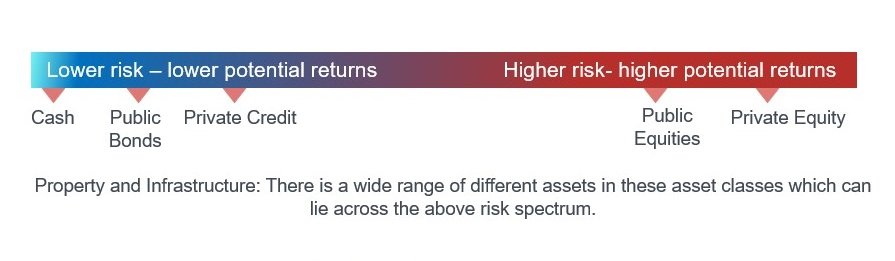

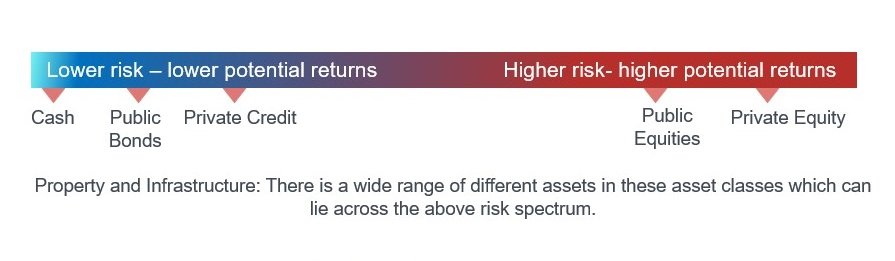

The risk-return spectrum

This image shows a spectrum from investment types with lower risk and less growth potential, towards those carrying higher risk, with the potential for higher growth.

Risk-return and your retirement savings

You may decide to remain in your Plan’s default option, where risk-return is already considered. Or you may decide to choose your own investment options. In this case, your tolerance for risk will help you decide which type of investments to invest in.

Investing when your retirement is some way off

Investing in assets with a higher potential for growth but greater risk is an option.

Investing when you are close to accessing your savings

As you get closer to accessing your savings, you may want to lower the level of risk in your investments. This may help to preserve the value of your savings as you get closer to accessing them.

Active and passive – different styles of fund management

Whichever asset classes you are thinking of investing in, it is likely that you will have a choice of active and passive funds:

- With an active fund, there is a manager who decides which investments your money should be channelled into. They will use their experience and skill to choose the investments. The fund charges are likely to be higher than those on a passive fund, in order to pay for the fund manager and the research and analysis they have access to.

- A passive fund simply attempts to match the performance of a stockmarket index, such as the UK’s FTSE All-Share, or the Dow Jones in the US. The allocation of investments in the fund is based on the investments that make up the index. There is less human decision-making than there is with an active fund, so charges are typically lower.

Want to make changes to your investments?

Learn more about how to self-select your own investments.